Note:

Re-domiciled companies will be regarded as companies incorporated in Hong Kong with effect from the date of re-domiciliation and will be required to comply with all the relevant filing requirements under the Companies Ordinance in the same manner as a company formed and registered under the Companies Ordinance unless otherwise specified.

identify and ascertain a person / persons who has / have significant control over the company; and

maintain a significant controllers register to be accessible by law enforcement officers upon demand. Please also see Q28.

No, a registered non-Hong Kong company is not required to keep a significant controllers register. Only a local company formed and registered under the Companies Ordinance (Cap. 622) or a former Companies Ordinance, excluding a listed company, is required to keep a significant controllers register.

No. It is not required to deliver the significant controllers register to this Registry for registration. However, the register must be kept at the company’s registered office address or a place in Hong Kong.

a registrable person who is a natural person that has significant control over the company; and

a registrable legal entity e.g. a company, which is a shareholder of the company that has significant control over the company.

The person holds, directly or indirectly, more than 25% of the issued shares in the company or, if the company does not have a share capital, the person holds, directly or indirectly, a right to share in more than 25% of the capital or profits of the company;

The person holds, directly or indirectly, more than 25% of the voting rights of the company;

The person holds, directly or indirectly, the right to appoint or remove a majority of the board of directors of the company;

The person has the right to exercise, or actually exercises, significant influence or control over the company;

The person has the right to exercise, or actually exercises, significant influence or control over the activities of a trust or a firm that is not a legal person, but whose trustees or members satisfy any of the first four conditions in relation to the company.

Please refer to the Guideline on the Keeping of Significant Controllers Registers by Companies (pdf format) for details and examples.

A company is required to take reasonable steps to identify the significant controller(s). The steps include reviewing the company’s register of members, articles of association, shareholders agreements or other agreements and issuing notice(s) to any person who is believed to be the significant controller and any person who is believed to know the identity of the significant controller.

In the case of a registrable person, if the company has already been informed of the person’s status as being its significant controller and all of the person’s required particulars have been provided to the company by the person or with the person’s knowledge, the company is not required to issue a notice to the person.

In the case of a registrable legal entity, the company has already been informed of the entity’s status as being its significant controller and all of the entity’s required particulars have been provided to the company, the company is not required to issue a notice to the entity.

No. If the company has already been informed of your status as being its significant controller and all your required particulars have been provided to the company by you or with your knowledge, it is not necessary for the company to issue a notice to you.

The company must add a note in its significant controllers register that the company has given a notice to a person whom it knows, or has reasonable cause to believe, to be a registrable person or registrable legal entity of the company but that person has failed to comply with the notice within the specified period of 1 month. Please see Examples of additional matters to be noted in the register.

The company should also consider reporting the case to the Companies Registry if the notice addressee fails to comply with the requirements set out in the notices.

Where a person can ensure that a company generally adopts the activities which the person desires, this would indicate “significant influence”. Moreover, where a person can direct the activities of a company, this would indicate “control”. Please refer to Chapter 10 of the Guideline on the Keeping of Significant Controllers Registers by Companies (pdf format) for more detailed explanations. The roles or positions of a person would not on their own result in the person being considered to be exercising significant influence or control. In determining whether to include your senior management officials in the significant controllers register, you should consider, inter alia, whether they have the absolute decision rights or veto rights over decisions in the running of the company’s business. If so, their particulars should be included in the significant controllers register. If you are in doubt, please contact the Companies Registry for assistance (hotline : 2867 2600; email : cr.scr@cr.gov.hk).

If, after taking all reasonable steps, no significant controller can be identified, the company should contact the Companies Registry for assistance (hotline : 2867 2600; email : cr.scr@cr.gov.hk).

The significant controllers register must contain, among others, the required particulars of the significant controller(s) and contact details of the designated representative of the company.

The particulars required include:

For a significant controller

Name

for a registrable person,

- correspondence address, identity card number (if the person does not have an identity card, the number and issuing country of the passport)

- for a registrable legal entity (e.g. a company),

- legal form, registration number, place of incorporation (governing law) and address of registered office

date of becoming a significant controller

nature of control over the company

For a designated representative

name

contact details

Please refer to the Guideline on the Keeping of Significant Controllers Registers by Companies (pdf format) for details.

Yes. If the company knows that it has no significant controller, it must state this fact in the significant controllers register.

A person who holds, directly or indirectly, more than 25% of the issued shares in the company, is a significant controller. Therefore, both shareholders are the significant controllers of your company and the particulars of both shareholders should be entered into the significant controllers register.

No. If there is a natural person A, who has significant control over your company through ABC Profits Limited, A is also the significant controller of your company. The particulars of ABC Profits Limited and A should be entered into the significant controllers register.

A person holds, directly or indirectly, more than 25% of the issued shares in the company, is a significant controller. Therefore, both the BVI company and you are the significant controllers of your company. The particulars of the BVI company and you should be entered into the significant controllers register.

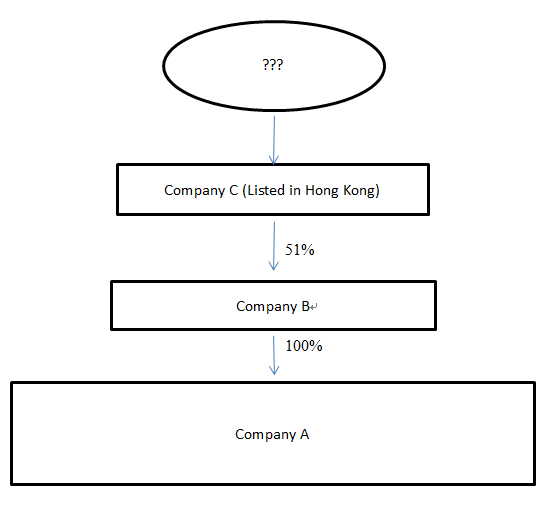

Although Company C is listed in Hong Kong, it is not a registrable legal entity of Company A and therefore does not fulfill the condition in section 653C. Company A is required to trace upwards to ascertain if there is any person having significant control over Company A through Company C, i.e. any person having a majority stake in Company C.

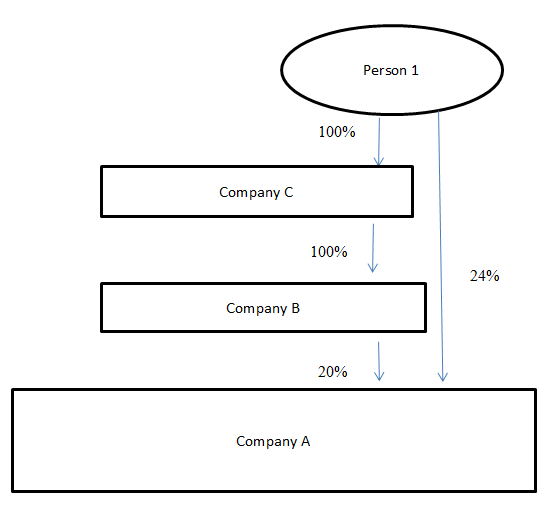

Yes, Person 1 is a registrable person of Company A by holding a direct interest in Company A, cumulative with an indirect interest in Company A through Companies C and B (totally more than 25% of the issued shares in Company A).

No, a share held by a nominee for another person is regarded as being held by that other person. Only the particulars of that other person (i.e. your friend) need to be entered into the significant controllers register.

Yes, the company has to carry out investigation to ascertain whether there is any person having significant control over the company through the overseas company.

A company must designate at least one person as its representative to provide assistance relating to the company’s significant controllers register to a law enforcement officer.

A company’s designated representative must be either a shareholder, director or an employee of the company who is a natural person resident in Hong Kong or, alternatively, an accounting professional, a legal professional or a person licensed to carry on a business as trust or company service provider.

- a director, employee or member of the company who is a natural person resident in Hong Kong; or

- an accounting professional, a legal professional or a TCSP licensee (i.e. a person licensed to carry on a trust or company service business in Hong Kong).

A company’s designated representative must be either (i) a director, employee or member of the company who is a natural person resident in Hong Kong or (ii) an accounting professional, a legal professional or a person licensed to carry on a trust or company service business (“a TCSP licensee”). If you are an employee of the holding company, you can be appointed as the designated representative of the holding company. If you are not a director, employee or member of the other companies under the same group, you need to fulfill condition (ii) above before you can be appointed as the designated representative of these companies. In other words, you can be appointed as the designated representative for all the other companies within the group if you are an accounting professional, a legal professional or a TCSP licensee.

The significant controllers register can be kept at the registered office of the company or any other place in Hong Kong.

Unless the significant controllers register is kept at the registered office of the company, a company must notify the Registrar of the place where the significant controllers register is kept or any change thereafter in Form NR2 within 15 days after the significant controllers register is first kept at that place or the change, as appropriate.

However, an existing company is not required to give notification to the Registrar if the significant controllers register is kept at the same place where the company’s register of members is kept. Please also see Q25.

No. An existing Company is not required to give notification to the Registrar if the significant controllers register is kept at the same place where the company’s register of members is kept.

No

No, a company is not required to deliver a Form NR2 for registration if since its significant controllers register (“SCR”) came into existence, the SCR has at all times been kept at the company’s registered office address.

Furthermore, an existing company (namely, a company which is in existence on 1 March 2018) is not required to deliver the Form NR2 if since 1 March 2018, the SCR has been kept together with the company’s register of members and the company has delivered to the Registrar a Form NR2 in respect of its register of members.

Companies Registry

Customs and Excise Department

Hong Kong Monetary Authority

Hong Kong Police Force

Immigration Department

Inland Revenue Department

Insurance Authority

Independent Commission Against Corruption

Securities and Futures Commission